When my spouse and I started the preliminary seek for our first house, I used to be in opposition to utilizing a realtor.

We knew the place we wished to purchase. We talked to the financial institution forward of time so we knew our finances. We might seek for properties on-line. We have been in negotiating place as a result of we didn’t have a home to promote (this was again in 2007 when it was exhausting to promote a home).

Why rent a realtor?

Then we went to a exhibiting and the realtor promoting the home began asking us questions.

Why aren’t you utilizing a realtor? As a purchaser you don’t pay a dime out of pocket. The vendor pays the client’s agent fee.

I didn’t actually know this on the time. Why wouldn’t we use one?! Offered! We acquired a realtor.1

We’ve been on the opposite facet of this transaction as nicely, the place we, the vendor, paid a 5-6% fee, break up evenly between each realtors.

I by no means actually questioned this follow as a result of that’s the best way it’s all the time been achieved, however somebody lastly put their foot down and sued the Nationwide Affiliation of Realtors.

Why?

It creates a battle of curiosity for the reason that purchaser’s agent successfully works for the vendor. I don’t utterly purchase that premise however it’s a weird follow when you concentrate on it that approach.

This weird follow may be lastly coming to an finish. Final week the NAR settled its case with a $400+ million payout, and now the realtor enterprise is in flux. House sellers will now not be pressured to pay the client’s fee.

I’ve extra questions and solutions at this level so listed here are the details I’m contemplating when it comes to what this implies subsequent when shopping for or promoting a home:

Will this influence housing costs? If the price falls from 6% to one thing like 2%, will housing costs lower to account for the decrease charges?

Contemplating how the endowment impact works for householders, I’m not sure it would work this manner.

However I’ll be fascinated by studying the analysis stories in a couple of years to see if there’s any linkage between decrease commissions and decrease housing costs.

Will homes turnover extra now? Transaction prices within the inventory market have been falling for years. As these obstacles to entry have damaged down, transaction quantity and turnover have shot up.

It’s like how individuals all the time drink extra at an open bar.

I’m undecided I’ve ever met a house owner who stayed of their house as a result of realtor commissions have been too excessive.

However it’s attainable we might see elevated exercise amongst actual property traders with decrease prices.

Will we see new actual property enterprise fashions? The present fee mannequin might lastly see some competitors. I’m guessing we’ll see realtors attempt to get forward of this by providing flat charges. There may be totally different tiers of service relying on how a lot you pay.

You would additionally see realtors who cost by the hour.

Extra negotiations will even happen now that customers scent blood within the housing waters.

Will we see a price warfare? Over the previous few many years, retail traders have been the most important beneficiaries of price wars within the fund world. Extra competitors and new price buildings also needs to profit house consumers and sellers.

I might count on to see some larger brokerages provide decrease charges to nook the market.

Actual property is likely one of the few industries the place expertise hasn’t been capable of break by in a giant approach. Will we now see tech companies make this house extra environment friendly and cost-effective?

Will we see fewer realtors now? In accordance with the Nationwide Affiliation of Realtors, there are greater than 106,000 actual property brokerage companies in the US.

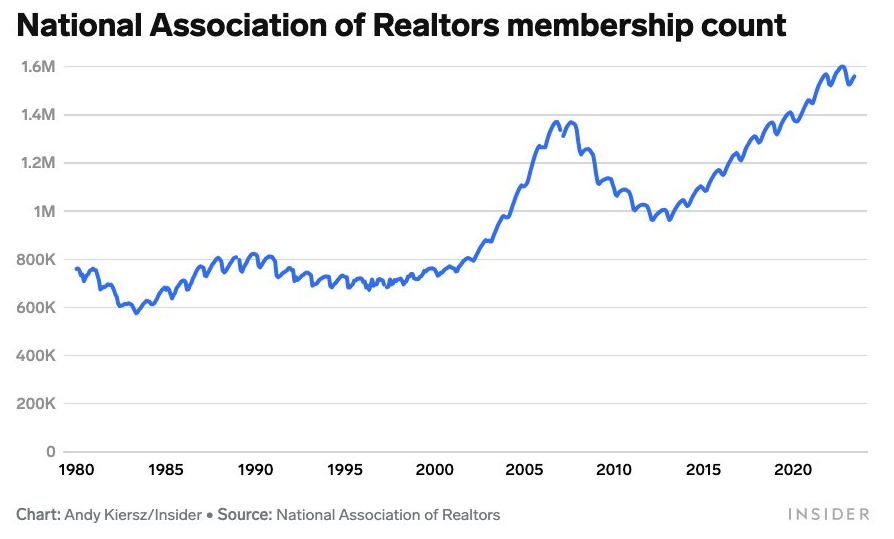

The NAR boasts practically 1.6 million members. Contemplating there are at present round a million present properties on the market within the U.S., there are clearly too many realtors.

There’s a Pareto precept on this house the place a lot of the gross sales are achieved by a small variety of realtors, however it will make sense for there to be some consolidation and fewer realtors within the years forward.

I might think about lots of the part-time gamers on this house will develop into casualties.

Who advantages probably the most? The simple reply is house sellers, who will (hopefully) pay a lot decrease charges. The downstream winners will in all probability be giant institutional traders, who can now extra effectively purchase and promote properties.

How lengthy will it take to see precise change? What if some consumers can’t afford the out-of-pocket prices of paying their very own fee? Will consumers and sellers simply negotiate and the vendor pays it anyway? Some consumers might write that into their contracts.

It could be good to see this business change in a rush, but it surely’s unclear how lengthy it would take to play out.

What are the unintended penalties? Are many first-time homebuyers screwed if they’ll’t pony up for a flat price or fee out of pocket? Will fewer individuals use a realtor altogether? Will the facility on this business shift to a brand new platform or firm that places collectively consumers and sellers?

This business has been caught previously for much too lengthy. I don’t know what all of it means simply but, however I’m excited in regards to the alternatives this might create for customers.

Michael and I talked about realtor commissions and rather more on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

Tips on how to Purchase a Home in At present’s Market

Now right here’s what I’ve been studying these days:

Books:

1We’ve used realtors for different housing transactions over time. I have a look at it like a monetary advisor — they are often of nice worth to some individuals. Others don’t want onw. It’s circumstantial.