It’s JULY already!

Within the phrases of my 8-yo daugther: OMG!

Time is flying by and I actually attempt to not let it get to me, however summer season is quickly coming to an finish earlier than it even actually started!

We’re busy within the new home, and haven’t even began packing down our previous home but! My spouse JUST began packing a number of packing containers final evening, and we now have begun promoting a few of our furnishings that we are going to not carry to the brand new residence (just because it’s lots smaller than our present one).

Throughout this manic two-household section I’ve needed to slim down the replace format in order to not spend an excessive amount of time on it. We have now two mortgages proper now, and our funds is a giant mess to be sincere! SO a lot paper cash will get burned once you purchase/promote a house…In case you can in some way handle to maneuver solely as soon as in your life, I extremely suggest that!

Anyway, it ought to all normalize in a 12 months or so…hopefully!

We’ve been working tirelessly on constructing a brand new backyard shed for the brand new home. We’d like a spot to retailer instruments and shit

There was an previous shed that we tore down, and we bought a brand new (nearly IKEA-like) that was speculated to take 2 days to assemble (based on the producer) – properly, 7 days later and we’re nonetheless not completed! HAHA

Individuals have been asking us why we’re not working INSIDE of the home. Sadly, we’ve needed to halt a lot of the work within the home, as a result of we now have found that that kitchen and the principle rest room has been linked to the unsuitable sewer line (rain water as a substitute of waste water). That is now unlawful, and thus it’s change into an insurance coverage case. They’ve 5 weeks lead time on consultants, they usually’ve advised us to halt all work in the home (if we would like them to pay for something)… *deep breaths* We knew it might be a problem, however now the deadline has been pushed again to an unknown cut-off date, due to the continuing insurance coverage case. We have now determined to present them 2 months. If they don’t give you one thing by then, we’re going to proceed the work regardless (I’ll take these fu**ers to court docket if I’ve to!). We don’t need to be dwelling within the backyard when winter comes, nevertheless it’s beginning to look increasingly probably. *deep breaths* It’s all good!…

In the meantime, my employer has determined to modify pension supplier. I might have opted to maintain my pension with the earlier supplier, however these b**tards has hefty charges for “inactive insurance policies” (if you happen to don’t proceed to contribute to your portfolio, they slap you with a charge – they usually all have this). So I made a decision to maneuver it…*deep breaths* This new pension supplier is the sixth greatest supplier within the nation. They’ve taken greater than 2 months to switch the funds and permit me to entry them (with the intention to put them again to work available in the market). 2 months!?! June and July has to date been a few of the finest yielding months for years! And my single greatest pile of money has been caught on the sideline. DON’T fear although (they are saying) – you get an curiosity in your money whilst you wait!…OH, nice – how a lot although?….1 % *face-palm*

*deep breaths*

So, in conclusion; don’t transfer home and don’t transfer your pension…That’s the perfect life/finance recommendation I can provide you guys proper now! HAHA

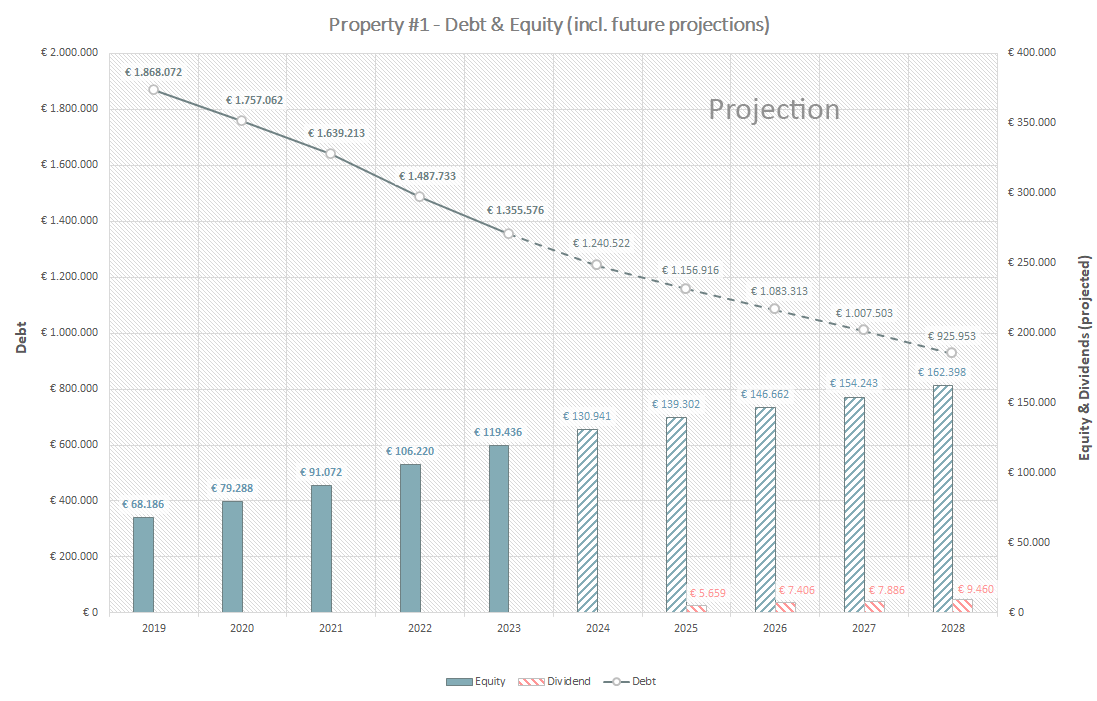

In different information! October 2023 is quick approaching, and people of you who’ve been following my journey for some time is aware of that this can be a huge milestone for our Property #1 funding. The 5-year mortgage is up for re-financing. The explanation why I carry it up now’s that you need to resolve 3 months upfront, if you wish to make modifications to the mortgage. In case you don’t do something, the mortgage will robotically get a brand new rate of interest, which can then be locked in for the subsequent 5 years. Provided that the rate of interest is document excessive for the time being it might be silly to lock the rate of interest for the subsequent 5 years (or would it not?!). Initially the plan at this level was to re-mortgage into a brand new 20-year (5-year flexrate) mortgage and borrow as much as the unique principal, with the intention to launch some fairness from the challenge. They name this “The energetic debt administration technique”. Effectively, to none of our shock the financial institution wasn’t too keen on this concept… The credit score market has tightened considerably prior to now couple of years, and because of this the banks are taking over manner much less danger on their books, in comparison with simply 2-3 years in the past.

The leases (two tenants) on the property are up for renewal in lower than 5 years. What I collect from the banks new tips, is that they need to make 100% positive that they are going to have the ability to get their a refund, so they are going to assist you to mortgage the property at 60% LTV (realkredit) so long as the remaining years on the lease(s) will cowl the reimbursement of the mortgage in full. This can be a important change, in comparison with 5 years in the past once we bought the property. Anyway, I used to be sort of ready for this, so it didn’t come as a giant shock to me.

Which means that we won’t be able to see any payouts from Property #1 till earliest 12 months 2025. In 2025 we could have paid off the 2nd mortgage (financial institution mortgage), and we will thus decide to make use of the free cashflow to payout a dividend to the buyers, or pay further on the first mortgage. Fortunately, I do know the group of buyers fairly properly by now – they are going to be hungry for money at this level, and the mortgage firm won’t be able to pressure us to alter the fee scheme for the first mortgage.

I’m under no circumstances unhappy or bummed out about this improvement really, as I presently don’t belief myself with cash HAHA. Higher that we maintain the fairness within the property as a substitute of getting it in my account (I’d most certainly apply it to foolish stuff like a brand new driveway, a rest room or perhaps a new automotive?!). It will after all profit our solvency within the challenge in the long term. The decrease the debt the decrease the curiosity funds

Our present mortgage permit us to alter the flex-time although, so we now have chosen to alter profile from F5 (5-year mounted) to F1 (1-year mounted). That is carried out within the expectation that the rate of interest can be decrease subsequent 12 months (who is aware of although?). Which means that we are going to consider the flex-time yearly any further (in comparison with each 5 years beforehand). This can be a important change within the danger profile of this challenge, and it additionally makes it lots more durable to foretell the properties’ finances for the approaching years, as a result of the rate of interest can transfer in each instructions…

Anyway, I’ve carried out just a little doodling with the intention to visualize the potential end result. If we challenge the present rate of interest out into the subsequent 5 years – whereas sustaining a really conservative estimated property worth – then that is what the Property #1 funding will appear like:

In 2027-2028 we should re-negotiate the leases. At this level I’m uncertain what to anticipate. Initially I had imagined that the tenants would need to proceed for one more 10-years, on related phrases as the primary 10…Nevertheless, given the present improvement I’m not positive that they might need to prolong their lease, until they get a reduction on the lease. – However that is pure hypothesis on my half. I don’t have any indications that this would be the case, however I’m making ready myself for such a situation at this level…This after all signifies that there’s no strategy to know for positive what the property can be value in 12 months 2029, as a result of it’ll rely on the leases. Will they be prepared to signal one other 10-year lease? In that case, what would be the phrases of the brand new leases? Will they be much like the earlier 10 years? Worse? Higher?…We don’t know till we get there…

That is additionally one of many the reason why I’ve chosen to not write up the worth of my 10% stake in Property #1 since we purchased it. Nevertheless, on paper my 10% share is now value nearly twice as a lot as we paid for it. This feels good to know, and I’m barely inclined to begin including this fairness to the Whole Stability chart (I had this some time again too, nevertheless it regarded a bit silly so I eliminated it once more).

Now to one thing just a little extra attention-grabbing! – The shed! As you may see from the primary web page of the meeting handbook – it’s been well-read! HAHA

It’s 12.1m2 (130sqft). The underside body was not included within the package. It’s construct onto of a screw basis, which signifies that your complete factor is supported by the underside body and 15 so-called groundplugs. They’re 75cm lengthy (29.5in) and also you screw them into the bottom utilizing an influence wrench. This too took a short time longer than anticipated. 8 out of 15 went into the bottom with out a hitch – the remaining took just a little further work. Time will inform whether or not 15 plugs is sufficient HAHA (it needs to be…).

It will likely be insulated (insulation not included!) so we will retailer instruments and furnishings and stuff in there all 12 months round. Wanting by my digital camera roll I’m happy with the end result to date! Nonetheless lacking inner insulation, cladding, electrics and linoleum flooring (none of which is included within the worth…). It will likely be painted black (paint not included!…). Quickly this challenge can be completed, after which it’s onwards to the subsequent!

So long as we’re not contributing to our Whole Stability, I don’t assume it is sensible to maintain updating this chart (additionally, I’m very lazy). We have now began dipping into the money stash to help our loopy constructing challenge, so I’ll quickly retire the Basic development chart from the month-to-month replace for now… (It shall return!).

Shifting may be very costly…

Watch out who you permit to handle your pension funds (that is true for any of your funds, actually).

We’re busy constructing a backyard shed, and have hardly even had any time to fret concerning the precise transfer (which can occur by the tip of this month).

Property #1 re-finance has been postponed, and thus there can be no payout this fall in any case. I used to be ready for this, so I’m under no circumstances bummed out about it – the longer term continues to be very shiny for this funding

See you subsequent month!