Hiya everybody! It’s now June already! – Which means that I’ve but once more fallen behind (as standard) with the month-to-month replace.

Final month the sale of our present main house went by way of – and so did the acquisition of our new future house.

Our new house is a renovation venture, and thus we received’t know for certain when we can transfer in. Nevertheless, we all know that we’ll be transferring OUT of our present house by the tip of July. Fortunately, we’ve already obtained the keys to our renovation venture (it was vacant). So we may have a spot to remain after we transfer out – this place simply received’t have a kitchen…or a rest room…

How are you going to stay in a spot with no kitchen and no lavatory?! It’s referred to as CAMPING, individuals!

These of you who know me (and my spouse) is aware of that after we go “tenting”, it’s the posh model WITH a kitchen and a rest room…So this time, we’ll get to go “glamping” in our personal yard. We’re planning to lease a mobile-home that can be positioned within the yard of the brand new place, till the renovation is completed (or no less than till we will transfer in).

How lengthy will this take?! – You ask. I’m 100% constructive that it’ll take longer than we count on…So I’d say anyplace between 3 and 6 months. My absolute hope and need is that we live within the new(ly) renovated home earlier than Christmas – however hopefully sooner…

Due to the scenario we’re now in with technically having two homes (with two mortgages) AND a cellular house (these issues aren’t low cost!) we now have determined to place the FIRE venture on pause for now. We’re going to want each spare € that we will discover to “fill within the holes” for the subsequent couple of months – and it’s additionally probably that we’ll be changing a portion of our Complete Stability into house fairness as an alternative…I’ve battled rather a lot with this resolution, and it has not been simple.

For the previous 5 years we’ve been laser targeted on saving cash to place into investments. Now we can be specializing in constructing our new house base, and in doing so we can be decreasing our future value base considerably. As soon as the mud settles (ha! Pun NOT supposed ) we must always have lowered our “working” prices by about 1/4. On the similar time, we may have lowered our mortgage by greater than 1/3. Which means that theoretically (I’ve achieved the maths – after all) we might be debt free inside 7-8 years – if we made this a precedence.

However NICK, you’ve at all times stated that striving to turn out to be debt free just isn’t mathematically sound!? WHAT GIVES?!

I do know, I do know. I stand by my earlier feedback with regard to debt.

Nevertheless, for the previous decade (nearly) cash has been near free (borrowing has been extraordinarily favorable). In Denmark we had a 1% 30-year mortgage at one level. Our flex-rate was detrimental for 4 years. We paid -0.33% on our mortgage at one level (then the financial institution add their charges and shit, which makes it not utterly free – however whenever you consider inflation, borrowing cash at these charges was basically FREE).

The rate of interest is now hovering round 5% in Denmark, and whereas I discover it extra probably that the speed can be decrease in 12-24 months (so does the banks btw – it’s not simply me ), I don’t significantly get pleasure from having to pay 5-6% to the financial institution each month (bear in mind the charges – they add nearly 1% on high of the going fee, relying in your LTV). Couple that with a inventory market that seems to nonetheless be considerably overvalued, I’m having a tough time justifying the chance premium to favor investments over debt settlement in the intervening time. Mainly you’ll be able to “gamble” and hope that the inventory market will generate common returns over the subsequent couple of years, however I significantly doubt that would be the case. Then once more, I’ve been fallacious about that stuff earlier than, so who is aware of

Anyhow, we now have not fairly selected the phrases of our new mortgage but, so I’ll replace you as soon as the ultimate funding is secured

As of now the financial institution is making massive cash on us, as a result of we’ve mainly purchased a home with out having launched the fairness from our present house but (this is not going to occur till September, most definitely). The banks love these form of conditions after all, as a result of they get to earn cash in each ends of the deal. The quantity of “paper cash” that goes to waste in such a tiny house-swap is astounding…That is additionally one of many drivers behind my need to (possibly) turn out to be utterly debt free. If I can keep away from paying the financial institution a single € on our NEXT home deal (sure, we’re already planning our subsequent transfer when our daughter ultimately transfer out haha). Doing our subsequent house deal with out involving the financial institution would heat my coronary heart!

Anyway, that is 10+ years from now, so rather a lot can occur till then haha!

Subsequent month we can be transferring into our momentary housing/camper, which can look one thing like this:

This small 2-bedroom “condo” is roughly 300sqft (30m2). Not precisely our dream house, however it is going to do for a few months I suppose

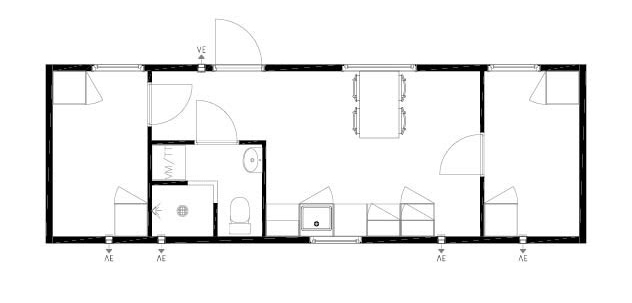

Our future house can be a bit greater and boast a handful of rooms. It’s going to look one thing like this (that is the present structure):

It’s 1380sqft (129m2). All of the rooms can be fitted with flooring to ceiling home windows, which may have a door so you’ll be able to stroll outdoors from any room of the home. We’re at the moment engaged on discovering the fitting home windows/doorways and an organization that may match them. As a result of it’s now required to have 3-layered thermo glass in your home windows/doorways they weigh a ton, so that you want 4 guys to suit them…This isn’t nice for the finances :-S

We after all have a finances for the construct, however we’ve already exceeded it for a lot of the classes haha…

Only for reference, right here is our general finances:

| Description | Value (DKK) | Value (EUR) |

| New outhouse | 50.000,00 kr. | € 6.711,41 |

| New Home windows and doorways | 150.000,00 kr. | € 20.134,23 |

| Driveway | 25.000,00 kr. | € 3.355,70 |

| Underfloor insulation | 35.000,00 kr. | € 4.697,99 |

| Underfloor heating | 75.000,00 kr. | € 10.067,11 |

| New flooring | 45.000,00 kr. | € 6.040,27 |

| Small lavatory | 50.000,00 kr. | € 6.711,41 |

| Massive lavatory | 75.000,00 kr. | € 10.067,11 |

| New Kitchen | 150.000,00 kr. | € 20.134,23 |

| Paint | 13.000,00 kr. | € 1.744,97 |

| Crops and backyard stuff | 5.000,00 kr. | € 671,14 |

| Cabinets for gymnasium/utility room | 10.000,00 kr. | € 1.342,28 |

| Cabinets for bed room+hallway | 25.000,00 kr. | € 3.355,70 |

| New electrics | 30.000,00 kr. | € 4.026,85 |

| Basis harm | 25.000,00 kr. | € 3.355,70 |

| Plumbing | 35.000,00 kr. | € 4.697,99 |

| Complete | 798.000,00 kr. | € 107.114,09 |

It’s fairly unlikely that we’ll be capable of are available on finances, as we preserve including new issues to the listing haha. I can chortle at it, as a result of I’ve needed to undertake a mindset that’s approach totally different from standard, in any other case I might go insane. Usually I don’t prefer to overspend, however to maintain my sanity by way of this ordeal, I’ve chosen to undertake a brand new mantra: There is no such thing as a drawback that may’t be solved by throwing extra money at it… (that is just for the reno-project, after all )

With such a big and huge venture I can’t be pinching each penny, as a result of it might most definitely drive me insane. I’m a bit of out of my comfort-zone, however I inform myself that these expenditures are momentary, and that they’re an funding in our future life in the home

Hopefully, each penny that we put into the venture will in the future return in type of fairness after we promote the home once more. Quite a lot of the finances is positioned in areas that you simply can not see (like underfloor heating), nevertheless it’s stuff like this that brings nice worth to a house. Should you’ve ever lived in a home with underfloor heating, you recognize what I’m speaking about.

Anyway, for the previous couple of weeks my head has been crammed with ideas concerning the house-building course of, and for now the FIRE venture will thus must take a backseat.

I’ll proceed to write down updates, albeit they may most likely be extra house-related than FIRE/Finance associated – however I hope you guys will stick round, because the FIRE venture will resume (after all) as soon as we now have settled in our new house (realistically 6-8 months from now…).

As at all times, I embody the Traditional Development Chart for monitoring objective:

The brand new-home renovation venture is all-consuming in the intervening time, which is why we’ve needed to put the FIRE venture on maintain for now.

As soon as the mud has settled from the construct venture, we are going to after all resume our FIRE journey.

Hope that you simply guys will proceed to comply with our journey, and I’ll after all try to maintain on making these updates. Nevertheless, as we is not going to be saving something in the direction of our Complete Stability for the approaching months, I’ll solely be updating the Traditional Development Chart on this interval.