4 issues I’m enthusiastic about for the time being:

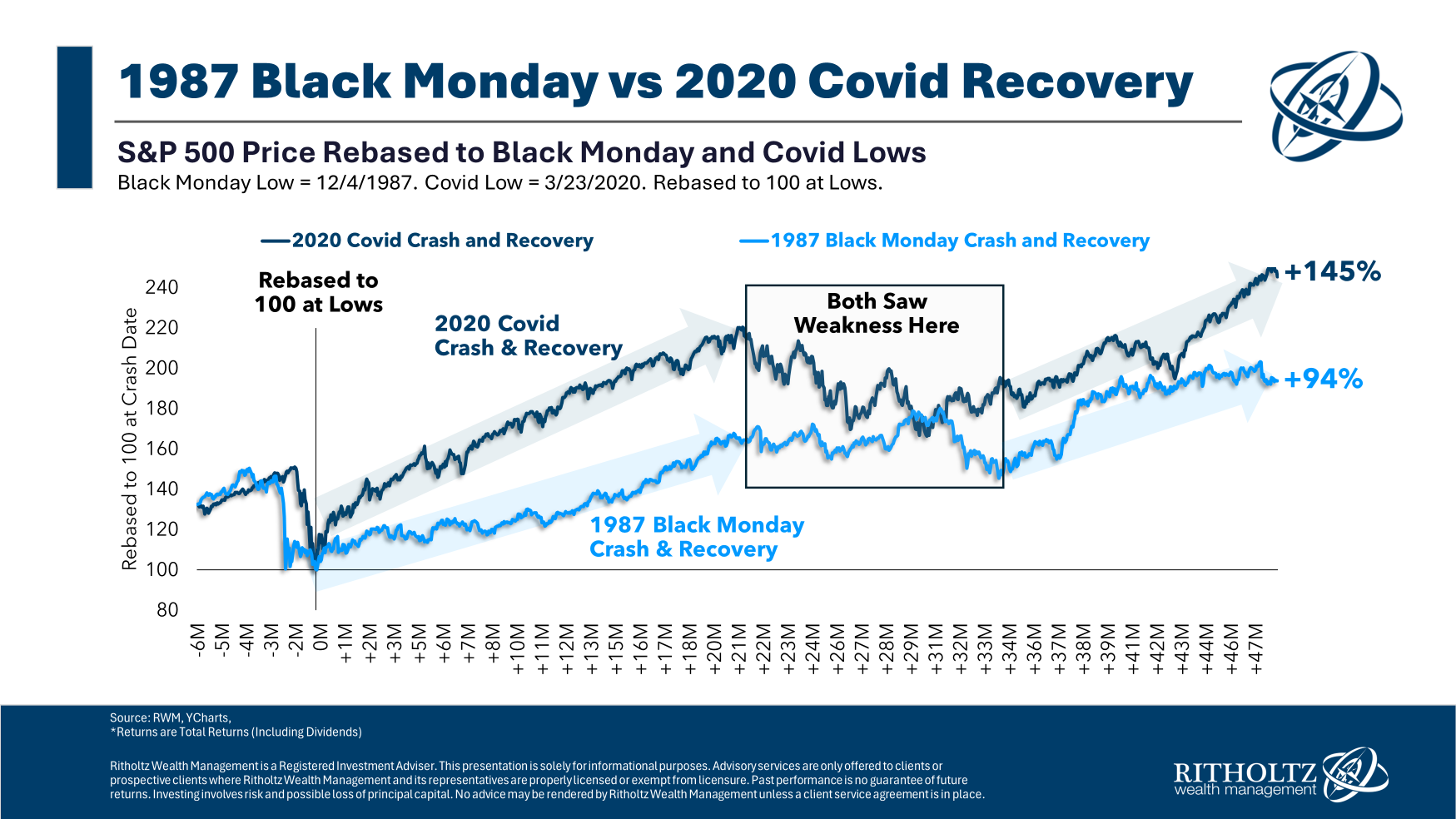

1. The Covid Crash was our 1987 crash. Within the 15 buying and selling days from October sixth by October twenty sixth in 1987, the S&P 500 was down 31%. That plunge contains Black Monday which noticed the market fall greater than 20% in a single day.

Over the following 4 years from the underside the S&P 500 was up rather less than 110% in whole. It was a beautiful shopping for alternative.

Within the 26 buying and selling days from late February twentieth by March twenty third in 2020, the S&P 500 was down 34%.

Within the 4 years or so because the backside of the Covid Crash in March 2020, the S&P 500 is now up almost 150% in whole. It was a beautiful shopping for alternative.

The bull market lasted properly over one other decade following the 1987 debacle. I don’t assume we’ll be that fortunate this time round however the Covid Crash is eerily just like Black Monday.

2. Individuals with cash proceed to spend cash. I’m on spring break this week with my household in Florida.

Like many locations, costs listed below are noticeably larger. Meals, drinks, motels, experiences — every little thing is dearer than it was just some brief years in the past.

However that’s not stopping individuals (me included) from spending cash.

I do know spring break shouldn’t be actual life, however individuals with cash are prepared to maintain spending even at elevated costs. This helps clarify a lot of what’s been occurring within the financial system lately.

This chart from Torsten Slok exhibits the share of spending damaged out by earnings:

Individuals with cash hold spending it.

Companies know they’ve pricing energy over shoppers and are taking benefit.

Who’s going to blink first?

3. Nothing ages properly within the markets. I’ve spent the previous few years writing positively in regards to the U.S. financial system. I’ve finished so to not predict what is going to occur sooner or later however to investigate what is going on within the current.

Final week, I made the case that we’re dwelling in our personal model of the Roaring 20s.

A completely bearish man who wears a bow tie1 even poked enjoyable at my analogy by declaring the unique Roaring 20s ended within the Nice Despair.

Jeez, I by no means considered that.

I get it. I’m most likely too glass-is-half-full more often than not.

However declaring that good occasions are often adopted by unhealthy occasions shouldn’t be an authentic thought.

In fact at this time’s good occasions will finish badly sooner or later!

There’s going to be a recession. There’s going to be a inventory market crash. We’re going to seek out out who’s been swimming bare when Mike Tyson punches you within the face and all of that stuff.

Many individuals mentioned my piece wouldn’t age properly. The individuals who have been forecasting a recession for 3 straight years didn’t age properly both.

The factor is, nothing ages properly within the markets as a result of they’re consistently altering. Markets are all the time and without end cyclical.

However the booms all the time greater than make up for the busts.

Continuously predicting the tip occasions may enable you to acquire subscribers however it doesn’t assist individuals earn cash.

For those who don’t benefit from the booms since you’re all the time frightened in regards to the busts you’re by no means going to get forward.

4. I’d wager on climate & water within the housing market. With the caveat that long-term developments are notoriously exhausting to foretell, the 2 housing themes I’m most bullish on within the coming many years are good climate and water.

I’ve traveled to Florida a handful of occasions previously few years, and each time I test Zillow, the housing costs appear to maintain rising.

The pandemic had one thing to do with this however you even have 10,00 child boomers retiring on daily basis and lots of of them need heat climate.

There are 70 million child boomers and so they management one thing like $70 trillion in belongings. We’re taking a look at 10-15 years of boomers shopping for locations in Florida, Arizona, the Carolinas and different heat locations.

Most of them have paid off mortgages and an obscene quantity of house fairness. Good luck betting towards this pattern.

They’ve some huge cash cash and are able to get pleasure from retirement so most boomers received’t fear about sky-rocketing insurance coverage premiums. They’ll roll the cube.

By the point the child boomers die off the oldest millennials will begin enthusiastic about early retirement and Gen X will already be there.2

At that time we may really see a reverse migration to the north and extra reasonable local weather as the warmth within the south turns into extra insufferable within the summers.

Proudly owning actual property by the Nice Lakes is my private local weather change hedge for the following 10-30 years.

Michael and I talked the inventory market, shopper spending, financial commentary, wealth inequality, Florida and extra on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

Are We Residing within the Roaring 20s?

Now right here’s what I’ve been studying recently:

Books:

1For those who’re in finance and put on a bow tie there’s a 95% probability you’re a permabear. These are the principles.

2Loopy however true. I’m 42 (occurring 43) and technically the oldest millennial alive. The child boomers have 20-30 years in retirement. By the point most boomers are of their 90s, the oldest millennials like me will probably be of their 60s and enthusiastic about retirement.