Hi there everybody! It’s that point of the month once more

As you’ll be able to in all probability learn from the headline it has been an thrilling month within the Complete Steadiness family.

The joy undoubtedly doesn’t come from our portfolio! It has but AGAIN managed to supply a detrimental development this month. – However lets not dwell an excessive amount of on that half as we speak (we’ll simply get bummed out!).

What’s up with “The gives”?!

Nicely, as you’ll in all probability know should you’re a daily follower, we’ve put our main house up on the market.

From the December 2022 replace:

Our present house just isn’t actually “FIRE-friendly” and it’s a little removed from our daughters college. We’d like for her to have the ability to stroll or bike house from college by herself (she is 8). Quite a lot of her classmates reside near the college, and most of them are in a position to stroll house from college by themselves (or go to their classmates). When our daughter has a playdate we’ve got to drive her, and whereas we knew this after we moved in (she had not began college after we moved), it has began to put on on her mother and father I hate “losing time on the highway”.

So these are the 2 main causes; The price of possession and the price of distance from our daughters college

However Nick, are you loopy? Promoting your house within the worst drawdown since 2009!?

That’s what I mentioned! (to my spouse). She stay optimistic that we’ll be capable to discover a purchaser. I stay (very) pessimistic…

It turned out that (but once more) my spouse had the higher hand right here. Apparently there was no purpose to be pessimistic. We’ve had showings each weekend since we began promoting the home, and 30 days after we went on-line we acquired a suggestion. The provide was 7% under our asking worth. Within the present market, I don’t assume it was a nasty first provide. We didn’t settle for it (after all), however began negotiating a worth that we may each reside with. It went on for a couple of weeks (WAY too lengthy should you ask me). We by no means agreed on a remaining worth – earlier than we abruptly acquired one other provide from one other purchaser. This purchaser had seen the property for the primary time on Sunday and the provide got here in on Monday. It was 5% under our asking worth. We negotiated for 1 day and ended up giving them a 3% low cost on our asking worth – and signed the deal on Wednesday. BOOOM!

Accomplished deal. – It’s transferring time! Up till this level I’ve had a psychological block in my head about that a part of the journey. I simply couldn’t think about the home promoting that quick, and I didn’t need to fear upfront over having to maneuver all our crap to a brand new location HAHA! Oh effectively, I suppose it’s now time to open up that may of worms…

Technically the finale sale of our house occurred in Could, so I’ll maintain the small print for the subsequent replace! *suspenseful music*.

I’ve grown drained and a bit of numb frankly, reporting about our portfolios lack of efficiency, so I’ll simply add that nothing noteworthy by way of our investments occurred this month!

We did nonetheless handle to interrupt one other financial savings report, and saved €2.666 this month. The approaching months will possible see 0 financial savings, as we’re gonna must pad our “new house building fund” considerably. Extra on this within the subsequent replace!

| Platform | Invested | Transactions | Final month | Present worth | Month-to-month earnings |

| Commodities | |||||

| GOLD (Cash) | € 5.333 | € 0 | € 6.500 | € 6.500 | |

| € 6.500 | € 6.500 | ||||

| Shares (Dividend portfolio) | |||||

| Financial institution of Nova Scotia (BNS) | € 1.000 | € 0 | € 1.144 | € 1.102 | € 13 |

| Enbrigde (ENB) | € 2.400 | € 0 | € 2.109 | € 2.142 | € 0 |

| PROREIT (PRV.UN) | € 2.018 | € 0 | € 3.647 | € 3.287 | € 17 |

| Toronto Dominion Financial institution | € 1.000 | € 0 | € 960 | € 932 | € 8 |

| TransAlta Renewables (RNW) | € 2.000 | € 0 | € 1.706 | € 1.705 | € 8 |

| True North Business REIT (TNT-UN-T) | € 3.552 | € 0 | € 1.956 | € 1.561 | € 9 |

| € 11.522 | € 10.729 | € 55 | |||

| Shares (Indices) | |||||

| iShares World Clear Power (IQQH) | € 6.667 | € 6.928 | € 6.422 | € 0 | |

| Xtrackers MSCI World ESG (XZW0) | € 2.721 | € 2.449 | € 2.431 | € 0 | |

| € 9.377 | € 8.853 | € 0 | |||

| Properties | |||||

| Property #1 | € 68.667 | € 0 | € 68.667 | € 68.667 | € 0 |

| € 68.667 | € 68.667 | € 0 | |||

| Crypto | |||||

| Nexo (BTC, ETH, MATIC, EURx) | € 0 | € 756 | € 851 | € 5 | |

| € 756 | € 851 | € 5 | |||

| Money | |||||

| Financial institution #1 money (predominant financial savings) | € 0 | € 0 | € 0 | € 0 | |

| Financial institution #2 Alternative cash | € 2.666 | € 42.515 | € 45.181 | € 51 | |

| Dealer account (CAD, EUR, DKK) | € 55 | € 406 | € 461 | € 0 | |

| € 42.921 | € 45.642 | € 51 | |||

| Complete stability | € 139.743 | € 141.242 | € 111 |

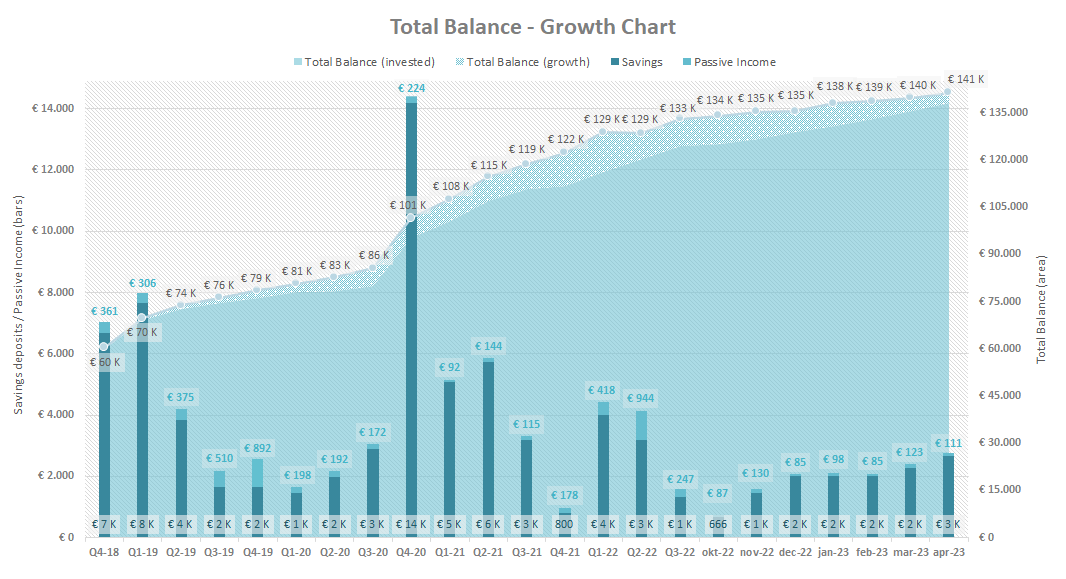

As at all times I embody the Basic Development Charts for monitoring function

Since we now know the gross sales worth of our present house, we additionally know our actual fairness. I’ll replace the graph with the precise numbers as soon as the transfer is accomplished (the cash truly takes months to reach – even after you’ve moved out! – In the meantime the banks are making killer cash on this delay).

You gained’t consider it! We bought our house. Maybe too cheaply?…We’ll know in a couple of years time

It’s transferring time! The approaching months will thus see restricted financial savings, as we’ll want the funds for varied constructions in our new house. Extra on this within the coming updates

We managed to tuck away a whopping €2.666 month, which was nice since our portfolio managed to lose about €1.100! Will it ever finish?!

Anyway, see you subsequent month for the thrilling reveal of our subsequent house!